Investors shouldn’t overlook this underappreciated quantum computing stock.

When IonQ (IONQ -5.85%) went public by merging with a special purpose acquisition company (SPAC) in October 2021, it called itself the only “public pure-play” on the quantum computing market. It provides its quantum computing power as a cloud-based service, and it’s shrinking down quantum processing units (QPUs) with its proprietary “trapped ion” technology.

IonQ’s stock started trading at $10.60 on the first day, nearly tripled to a record high of $31 a month later, but now trades at about $8. Like many other SPAC-backed tech companies, IonQ burned out as it broadly missed its pre-merger forecasts. Rising interest rates also highlighted its steep losses and popped its bubbly valuations.

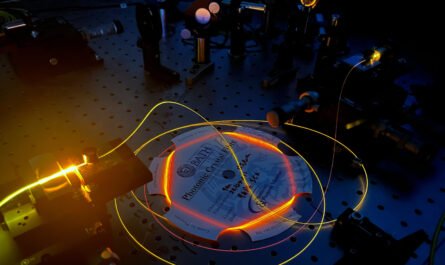

Image source: Getty Images.

The bears were skeptical of its miniaturization capabilities, running its quantum computing services on Honeywell‘s machines, and using its proprietary AQ (algorithmic qubit) metric — instead of the industry-standard quantum volume (QV) metric or regular qubits — to measure its computing power. The departure of its co-founder and chief scientist Chris Monroe last October raised even more red flags.

Analysts still expect IonQ’s revenue to expand at a compound annual growth rate (CAGR) of 91% from 2023 to 2026. That’s a bright outlook, but its stock isn’t cheap at more than 40 times this year’s sales. So for now, investors might want to check out other quantum computing stocks that aren’t attracting as much attention as IonQ — but might have a better shot to generate bigger gains.

Could one of those overlooked small-cap plays be Rigetti Computing (RGTI -5.36%)?

What does Rigetti Computing do?

Rigetti Computing was founded in 2013 by Chad Rigetti, a physicist who had previously worked on quantum computers at IBM. Rigetti Computing designs and manufactures quantum integrated circuits for quantum computers, and it operates a cloud platform called Forest which enables its developers to write their own quantum algorithms. That all-in-one approach makes it a “full-stack” quantum computing company.

Like IonQ, Rigetti went public by merging with a SPAC in March 2022. Its stock started trading at $1.92 on the first day, but it now trades at just over $1. Prior to its market debut, Rigetti claimed it could grow its revenue from an estimated $7 million in 2021 to $34 million in 2023. It actually generated $8 million in revenue in 2021, but that figure only rose to $13 million in 2022 and dipped to $12 million in 2023. It blamed that slowdown on the uneven timing of its government contracts.

That deceleration indicated its target for generating $594 million in revenue in 2026 was too bullish. Rigetti also stepped down as its president and CEO in December 2022; the company didn’t provide any reasons for his departure. Those setbacks drove a lot of investors away as interest rates rose.

Analysts expect Rigetti to generate only $65 million in revenue in 2026 — but that would still represent an impressive CAGR of 76% from 2023. They also expect it to gradually narrow its annual net loss from $75 million in 2023 to $60 million in 2026.

Most of that growth will likely be driven by its new Novera QPU, which it rolled out last December. It’s already sold its first Novera QPUs to big U.S. government labs — including the Superconducting Quantum Materials and Systems Center (SQMS) and Air Force Research Lab (AFRL) — and Horizon Quantum Computing in Singapore.

With a market capitalization of $179 million, Rigetti trades at 12 times this year’s sales and looks significantly cheaper than IonQ. Rigetti’s insiders have also bought more than twice as many shares as they sold over the past 12 months, while IonQ’s insiders only acquired about 12% as many shares as they dumped during the same period.

What advantages does Rigetti have over IonQ?

Rigetti’s business model is more capital intensive than IonQ’s, but it’s arguably a stickier one that locks its customers into its full stack of chips, software, and integration services. It focuses less on experimental miniaturization technologies like IonQ, and it measures its computing power in standard qubits instead of alternative AQs.

Rigetti is still a tiny company that only held $35.1 million in cash and equivalents along with $46.5 million in liabilities in its latest quarter. Its number of outstanding shares has also risen 45% over the past two years as it has issued more shares to raise more cash and cover its stock-based compensation.

But despite those risks, Rigetti might still be a better play on the nascent quantum computing market than IonQ. It’s cheaper, it’s more broadly diversified, and it doesn’t rely on opaque proprietary metrics to benchmark its computing power.

Leo Sun has no position in any of the stocks mentioned. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.